E-invoicing has become a crucial part of business operations with the rise of digital tax regulations. A key question many businesses face is: When should you issue an official e-invoice?

This article dives deep into the recommended practices, regulatory requirements, and potential pitfalls, backed by real-world examples and case studies.

Understanding E-Invoice Regulations

What Does the Regulation Say?

There are some users mentioning that you can issue an e-invoice anytime within the same month the sales transaction occurs. For example, a sale made on 1st January 2025 can have its e-invoice issued anytime until 31st January 2025. Some also mention is within 7 days of the month end.

They may both be true.

In LHDN Specific Guideline, there’s an example for sales occur, and the person need to request for official e-invoice within that month. Mainly I think is due to if there’s no request, then it will be included as a Consolidated e-Invoices. Which for Consolidated e-Invoices, you can issue that within 7 days of the end of previous month.

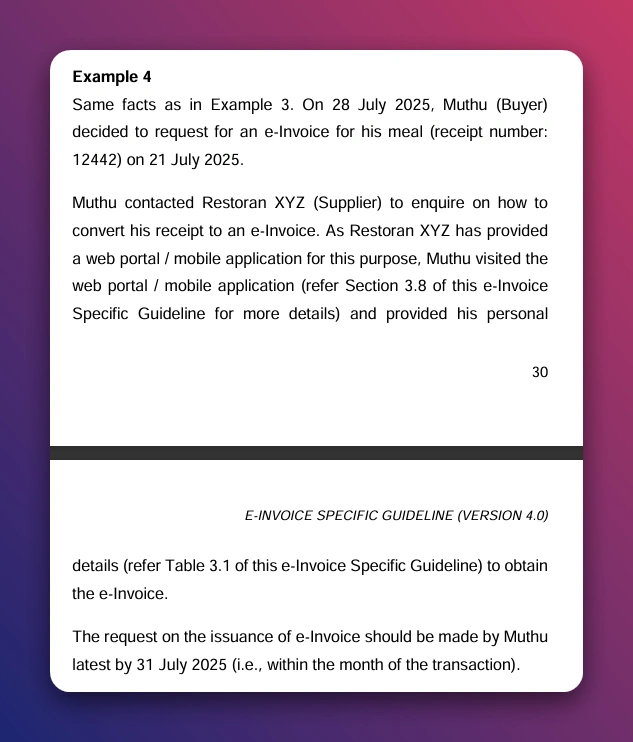

LHDN e-Invoice Specific Guideline V4.0, Example 4 on Page 30, and Example 5 on Page 31.

You can issue e-Invoice any time you want?

Do note that some users do think that you can issue e-invoice anytime you want. Mainly is due to Question 27, at the PART 2: SCOPE AND PROCESS, item (iii) Issuance of e-Invoices.

Do businesses need to submit an e-Invoice within the same day the transaction is being made?

There is no specific requirement on the timing of e-Invoice issuance, except in specific cases such as consolidated e-Invoice, self-billed e-Invoice for importation of goods / services and e-Invoice for foreign income.

Initially I also thought that you can just issue the e-invoice anytime, no need to submit to LHDN within 72 hours, or within the same month, or even the same year?

However, at the end of the answers there a sentence saying:

Where any specific legislation is applicable, you may proceed to follow as per the said legislation.

This sentence essentially means that if there is a specific law or regulation that applies to a particular situation, you should follow that law or regulation.

This implies that the answer provided in this FAQs document may not cover every possible scenario, and in cases where specific legislation exists, that legislation takes precedence and should be adhered to.

This ensures that you remain compliant with all relevant legal requirements.

My understanding on this FAQs answer

After some thoughts, it doesn’t sound logical if we can issue e-invoice anytime we want. That’s where I stumble upon the “within same month” below as Example 4 in E-INVOICE SPECIFIC GUIDELINE (VERSION 4.0) page 30.

Basically, if any e-invoice was requested and to be issued. It should be within the month of the transaction. Of cause, if the buyer never requests, it should be in under consolidated e-invoice.

So logically it also meant “within the same month”, but in consolidated e-invoice format. Which is being supported with the Example 5 in E-INVOICE SPECIFIC GUIDELINE (VERSION 4.0) page 31.

However, this doesn’t really explain why our recommendations are to issue the official e-invoice within 72 hours.

We will get to that below with our observation of how MyInvois Portal, and LHDN’s SDK API, and also how other accounting system are handling.

The 72 Hours Rule

While the regulation provides flexibility, it’s important to note a critical limitation imposed by the MyInvois portal and LHDN’s API:

- The “Issue Date” of an e-invoice cannot be more than 72 hours earlier than the “Submission Date.”

This means that if a sale occurred on 1st January 2025, and you’re issuing the e-invoice on 26th January 2025, the “Issue Date” cannot be set as 1st January 2025 without triggering a system error.

NOTE: We are not talking about the scenario like the Example 4 & 5 above. Intended example are mainly for those with general B2B scenarios.

Example in MyInvois Portal, Bukku, and AutoCount Cloud Accounting.

Why This Rule Matters

This rule ensures that e-invoices reflect accurate, timely data. The “Issue Date” is typically interpreted as the “Invoice Date” normally, tying it closely to the original sales transaction date.

This is what we believe is a control point that LHDN put in place to get more timely and accurate data.

We refer to the LHDN e-Invoice SDK Frequently Asked Questions

What action should be taken when I encounter the submission error “Issuance date time value of the document is too old and cannot be submitted”?

If it pertains to the Submit Document API, review the “propertyPath” for detailed information and adjust the date to ensure it is within 72 hours before submission.

Other than this, we also notice in LHDN e-Invoice SDK Invoice v1.1 document type structure. The property for e-Invoice date & time have a “*NOTE” there.

The note as you can see above carries a message “The date / time must be the current date / time”. Although, like how we tested, currently LHDN’s API do allow if within 72 hours.

We also check around with other e-invoicing solutions provider, and ClearTax’s Frequently asked questions (FAQs) | Product Help and Support also have the explanation that support this.

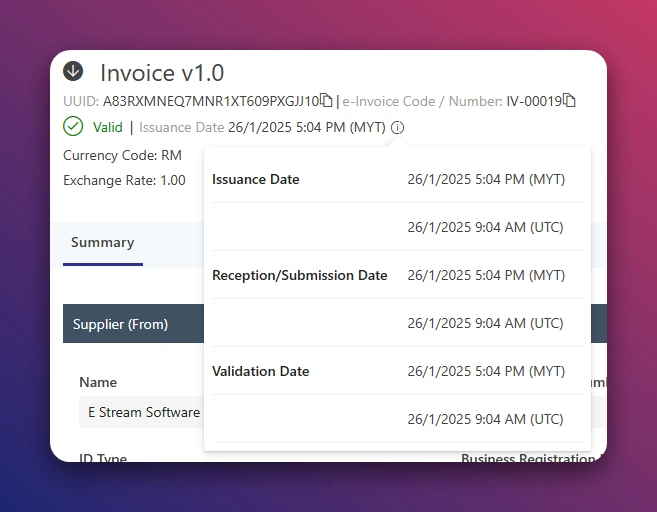

Of cause, these are based on the general understand that the “invoice date” you put in any accounting system, will be pass to this “e-Invoice Date” and “e-Invoice Time”. Which will be the “Issuance Date” at the MyInvois Portal e-Invoice Document

Referring to all the above reference, examples, and the LHDN public guidelines, documents, and testing. Hence, we came up with the recommendation that if can, issue the e-invoice within 72 hours of the transaction being done.

Best Practices: When to Issue Your E-Invoice

Align “Invoice Date” with “Issue Date”

To maintain consistency and avoid errors, it’s recommended to issue e-invoices within 72 hours of the actual transaction date. For instance, if you make a sale on 1st January 2025, aim to issue the e-invoice by 4th January 2025.

Benefits of Following the 72 Hours Rule

- Data Consistency: Ensures that invoice records are aligned with sales transactions.

- Compliance: Reduces the risk of submission errors on the MyInvois portal.

- Simpler Reconciliation: Makes it easier to track and reconcile invoices.

- Streamlined Search & Filtering: Speeds up internal processes, especially for audits.

Case Study: The SQL ERP and Middleware Issue

The SQL ERP Test

A user claimed that SQL ERP allows backdating an e-invoice beyond the 72-hour rule. In their test:

- The sale occurred on 1st January 2025.

- The invoice was submitted on 26th January 2025.

- The “Invoice Date” in SQL was set as 1st January 2025 and the submission was validated successfully.

However, from the screenshot itself the “Issuance Date & Time” have been cut off due to screen size.

Therefore, we tested it our self on SQL Account (E INVOICE) Demo Site as below:

From our investigation, the SQL system’s “Invoice Date” sent to LHDN as “Issuance Date & Time” defaulted to the submission date: 26th January 2025. This creates a discrepancy where the recorded invoice date (01/01/2025) in the SQL system, and does not match the actual LHDN recorded e-Invoice issue date (26/01/2025).

Possible Compliance Issue if SQL ERP allow backdate of e-Invoice over 72 Hours

There was another example given was, it was backdated until 30/08/2024 for the einvoice date.

In this case, assuming the FYE (Financial Year End) is Dec 2024, and haven’t close the period. The sales were recorded in the SQL ERP system as FY 2024 sales, with financial data like tax, inventory, and other records all recognized in 2024.

However, when submitted to the LHDN MyInvois Portal, the “Issue date” is recorded as 26/01/2025. This means LHDN recognizes it in the company’s FY 2025 rather than FY 2024, creating an indirect data inconsistency and potential compliance issues that could lead to incorrect tax filings.

This misalignment affects tax calculations, SST, and audits, as financial data recorded in the SQL ERP system differs from the official records submitted to LHDN.

Middleware Test

A similar issue was identified by me in a middleware system during pre-launch testing.

Initially, the middleware allowed backdated invoices also similarly to SQL, with the “Creation Date” of the einvoice document sent as the LDHN’s “Issuance Date”. Which led to inconsistencies in the data sent to LHDN, and breaking the intended control point enforced in the front-end billing system.

Thankfully, this was corrected before implementation.

Key Takeaway

While SQL ERP and possibly some other systems may appear to allow backdating, the “Issue Date” ultimately submitted to LHDN might be defaults to the current date. This can lead to data discrepancies and potential consistency issues later on.

Best Practices for Issuing e-Invoices

Based on the regulatory guidelines and the case study above, here are some best practices for issuing e-invoices:

- Issue e-Invoices Within 72 Hours: To ensure compliance with MyInvois Portal requirements and maintain data consistency, issue e-invoices within 72 hours of the sales transaction.

- Align “Invoice Date” with “Issue Date”: Ensure that the “Invoice Date” matches the “Issue Date” to avoid discrepancies and improve data integrity.

- Avoid Backdating: While some systems may allow backdating, it’s best to avoid this practice to prevent data inconsistencies and potential discrepencies issue.

- Use Reliable e-Invoicing Software: Choose e-invoicing software that adheres to regulatory requirements and promotes best practices. Following the control point and data behavior of MyInvois Portal

FAQs About E-Invoice Issuance

Yes, you can issue an e-invoice after the transaction date. It should be within the same month as the transaction. Be it in official e-invoice format, or in the consolidated e-invoice format.

We just recommending to issue within 72-hour rule, due to if “invoice Date” want to be recorded as “Issue Date” in LDHN MyInvois Portal for data accuracy and consistency.

The MyInvois portal actually doesn’t allow and LHDN’s API will reject the submission. Always ensure the “Issue Date” is within 72 hours of the submission.

Aligning these dates ensures data consistency, simplifies reconciliation, and prevents confusion during audits or inspections.

Is not a hard compliance but is like a best practice in the current MyInvois Portal & LHDN’s API control.

Currently, the 72-hour rule is enforced by the MyInvois portal and LHDN’s API. While regulations may allow flexibility, system limitations often most likely dictating the compliance.

We are talking mainly in IT technicality perspective, for best practices for long term data consistency, and accuracy. Especially that MyInvois Portal only will hold 2 years of the documents data. So is very crucial to maintain proper data accurately with what actually submitted to LHDN in MyInvois Portal.

In Summary

Issuing an e-invoice promptly is not just about regulatory compliance; it’s also about maintaining accurate records and ensuring operational efficiency. By following the 72-hour rule and aligning your “Invoice Date” with the “Issue Date,” you’ll avoid some headaches down the line.

If need any help, can check out our e-Invoices services page to see how we can help, or take a look at our e-Invoice related articles here.